Getting familiar with Medicare Advantage Plans

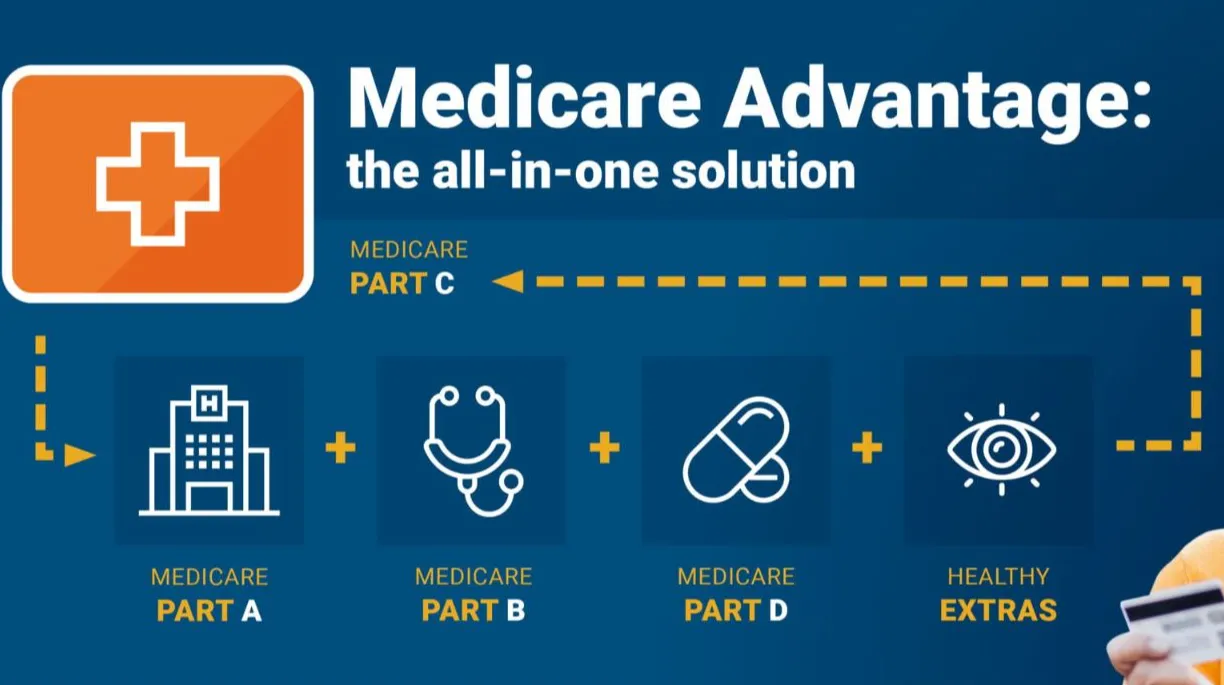

Medicare Advantage Plans are provided by private Insurance carriers that contract with Medicare to deliver Part A in addition to Part B benefits in one integrated format. In contrast to Original Medicare, Medicare Advantage Plans commonly offer extra coverage such as drug coverage, dental care, vision services, with wellness programs. Such Medicare Advantage Plans operate within specific coverage regions, making geography a critical consideration during comparison.

Ways Medicare Advantage Plans Vary From Traditional Medicare

Original Medicare offers wide medical professional choice, while Medicare Advantage Plans typically use organized networks like HMOs even PPOs. Medicare Advantage Plans can include referrals even network-based providers, but they frequently offset those constraints with predictable expenses. For countless individuals, Medicare Advantage Plans website deliver a blend between cost control and also enhanced coverage that Traditional Medicare alone does not typically include.

Which individuals Might Look into Medicare Advantage Plans

Medicare Advantage Plans appeal to individuals seeking managed healthcare delivery not to mention potential cost savings under a single plan structure. Beneficiaries handling chronic medical issues often prefer Medicare Advantage Plans because coordinated care approaches reduce complexity in treatment. Medicare Advantage Plans can further interest individuals who prefer packaged coverage options without maintaining separate secondary coverages.

Eligibility Guidelines for Medicare Advantage Plans

To be eligible for Medicare Advantage Plans, enrollment in Medicare Part A and Part B required. Medicare Advantage Plans are available to most people aged sixty-five or older, as well as under-sixty-five people with qualifying medical conditions. Participation in Medicare Advantage Plans is based on living status within a plan’s coverage region also timing that matches approved sign-up windows.

Best times to Enroll in Medicare Advantage Plans

Timing holds a vital part when joining Medicare Advantage Plans. The Initial Enrollment Period surrounds your Medicare qualification milestone not to mention permits initial choice of Medicare Advantage Plans. Missing this timeframe does not eliminate access, but it does change available opportunities for Medicare Advantage Plans later in the calendar cycle.

Annual not to mention Qualifying Enrollment Periods

Each fall, the Annual enrollment window allows enrollees to switch, remove, and/or enroll in Medicare Advantage Plans. Special Enrollment Periods are triggered when life events happen, such as relocation with coverage termination, allowing changes to Medicare Advantage Plans outside the standard schedule. Knowing these timeframes supports Medicare Advantage Plans remain within reach when conditions evolve.

How to Evaluate Medicare Advantage Plans Effectively

Comparing Medicare Advantage Plans requires care to more than recurring payments alone. Medicare Advantage Plans differ by network structures, out-of-pocket spending limits, drug lists, as well as coverage conditions. A thorough assessment of Medicare Advantage Plans assists aligning healthcare priorities with plan models.

Expenses, Benefits, also Network Networks

Recurring costs, copays, & annual maximums all influence the overall value of Medicare Advantage Plans. Certain Medicare Advantage Plans feature low monthly costs but higher cost-sharing, while others emphasize predictable spending. Provider availability also differs, making it necessary to check that regular doctors participate in the Medicare Advantage Plans under consideration.

Prescription Coverage and also Extra Benefits

Many Medicare Advantage Plans offer Part D prescription coverage, streamlining medication handling. In addition to prescriptions, Medicare Advantage Plans may offer fitness programs, transportation services, along with OTC allowances. Evaluating these elements helps ensure Medicare Advantage Plans fit with ongoing medical requirements.

Joining Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can occur digitally, by telephone, and/or through authorized Insurance professionals. Medicare Advantage Plans require correct personal information and also confirmation of eligibility before activation. Submitting registration carefully helps avoid processing delays and/or unexpected benefit gaps within Medicare Advantage Plans.

The Value of Licensed Insurance Agents

Licensed Insurance Agents assist interpret coverage details with describe differences among Medicare Advantage Plans. Speaking with an experienced professional can clarify network restrictions, benefit boundaries, and also costs associated with Medicare Advantage Plans. Professional assistance frequently simplifies decision-making during enrollment.

Frequent Mistakes to Prevent With Medicare Advantage Plans

Ignoring doctor networks details remains among the frequent errors when selecting Medicare Advantage Plans. An additional challenge centers on focusing only on monthly costs without accounting for annual spending across Medicare Advantage Plans. Reading coverage materials thoroughly helps prevent surprises after sign-up.

Reevaluating Medicare Advantage Plans Every Year

Medical requirements shift, also Medicare Advantage Plans adjust annually as well. Reassessing Medicare Advantage Plans during open enrollment allows adjustments when coverage, costs, and providers shift. Consistent assessment ensures Medicare Advantage Plans matched with present healthcare needs.

Reasons Medicare Advantage Plans Continue to Increase

Participation trends show increasing interest in Medicare Advantage Plans across the country. Additional benefits, structured spending limits, not to mention managed healthcare delivery support the growth of Medicare Advantage Plans. As offerings expand, well-researched evaluation becomes even more important.

Long-Term Value of Medicare Advantage Plans

For numerous enrollees, Medicare Advantage Plans offer reliability through integrated benefits with organized healthcare. Medicare Advantage Plans can minimize management complexity while encouraging preventive care. Selecting suitable Medicare Advantage Plans creates peace of mind throughout later life stages.

Compare plus Choose Medicare Advantage Plans Today

Taking the right step with Medicare Advantage Plans begins by exploring available options as well as checking qualification. If you are entering Medicare even revisiting current benefits, Medicare Advantage Plans present versatile coverage options created to support different medical priorities. Review Medicare Advantage Plans today to find a plan that aligns with both your medical needs also your financial goals.